David Ancelovici

Director of the Tax Group

David Ancelovici leads the Tax Group of our firm.

As director of the Tax Group, David Ancelovici has consolidated this area of practice within the firm. He has guided his professional practice in planning, restructuring and structuring of assets, and he has done so by focusing mainly on cross-border investments and their respective tax treatment.

Practice areas

Tax, Family businesses, Business groups, Fusions and acquisitions, Venture capital, Compliance, Tax litigation

He has dedicated a large part of his time to advising companies and family assets, either in the structure of their businesses and/or in the destination and tax treatment of their investments. His clients recognize his high-quality standard in his work, continually highlighting the security with which he provides his services, which has allowed him to develop long-term and trusting relationships.

Additionally, he continuously advises startups in their different stages of development, both from the beginning and in the financing stage. His extensive experience in the ecosystem has allowed him to deepen his knowledge of X-Tech industries.

Education

Lawyer, Universidad Adolfo Ibáñez (2012).

Master in Tax Management and Direction, Universidad Adolfo Ibáñez (2017).

Adv. LL. M. International Tax Law, International Tax Center, University of Leiden, The Netherlands (2020).

Work experience

Albagli Zaliasnik (2019 to date).

Pérez Videla Abogados (2015-2018).

BTG Pactual Chile (2015).

EY (Ernst & Young) Chile (2012-2014).

Teaching experience and memberships

Assistant of courses related to agreements at the LLM in Tax at the Pontificia Universidad Católica de Chile and at the Universidad Adolfo Ibáñez.

IBA – International Bar Association.

IFA USA – International Fiscal Association.

Languages

Spanish, English.

Featured experience

Representation of a multinational company before the Internal Revenue Service, for undue charges associated with the export of services.

Advising a company in the technology industry in the acquisition of financing and subsequent transfer of assets, through a structure in the United States (startup).

Advice on the tax treatment of payments between related parties of multinationals, ruling on both national and international effects.

Advice on foreign reorganizations and tax impact in Chile, involving direct and indirect transfers of participation in Chilean companies.

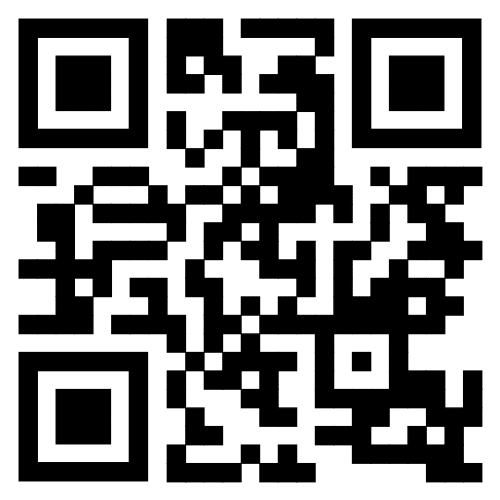

CONTACT DAVID

dancelovici@az.cl